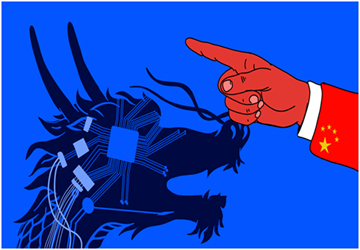

Ten Effects of Chinas Crackdown on Tech Stocks

Author: Franco Salzillo

Did you know that the Chinese word for "crisis" (危机) is a combination of the characters for "danger" and "opportunity"? That's right; even in the darkest of times, there's always a glimmer of hope. And that's exactly what we're going to explore today. We'll look at ten effects of China's crackdown on tech stocks and the effects, both the good and the bad. In this crackdown, the following were the companies most affected.

Alibaba Group Holding Ltd (BABA)

Alibaba, one of the world's largest e-commerce companies, has been hit hard by the Chinese government's crackdown on the tech industry. The company has been fined billions of dollars for antitrust violations, and the Chinese government publicly criticized its founder Jack Ma.

Tencent Holdings Ltd (TCEHY)

Tencent, a major player in the gaming and social media industries, has also been hit hard by the Chinese government's crackdown on the tech industry. The company has been fined for antitrust violations and faced increased scrutiny over its data privacy practices.

Meituan (MPNGF)

Meituan, a Chinese food delivery, and online services company, has been hit hard by the Chinese government's crackdown on the tech industry. The company has faced antitrust investigations and has been accused of exploiting its delivery workers.

JD.com Inc. (JD)

JD.com, a Chinese e-commerce company, has faced increased regulatory scrutiny due to the Chinese government's crackdown on the tech industry. The company has been fined for antitrust violations and accused of monopolistic practices.

Pinduoduo Inc. (PDD)

Pinduoduo, a Chinese e-commerce platform focusing on group buying, has faced increased regulatory scrutiny as part of the Chinese government's crackdown on the tech industry. The company has been accused of engaging in unfair competition and has also been fined for antitrust violations.

Baidu Inc. (BIDU)

Baidu, a Chinese search engine company, has faced increased regulatory scrutiny due to the Chinese government's crackdown on the tech industry. The company has been accused of monopolistic practices and criticized for handling user data.

Kuaishou Technology (KSKHF)

Kuaishou, a Chinese short-video-sharing app, has faced increased regulatory scrutiny due to the Chinese government's crackdown on the tech industry. The company has been accused of hosting inappropriate content and faced criticism over its data privacy practices.

NetEase Inc. (NTES)

NetEase, a Chinese internet technology company, has faced increased regulatory scrutiny due to the Chinese government's crackdown on the tech industry. The company has been accused of monopolistic practices and criticized for handling user data.

Xpeng Inc. (XPEV)

Xpeng, a Chinese electric vehicle company, has faced increased regulatory scrutiny due to the Chinese government's crackdown on the tech industry. The company has been accused of unfair competition and has faced criticism over its data privacy practices.

Didi Global Inc. (DIDI)

Didi faced increased regulatory scrutiny as part of the Chinese government's crackdown on the tech industry. The company recently went public in the United States but was subsequently ordered to stop accepting new users by Chinese regulators due to concerns over data security.

Now let's get into the gist; here are ten effects of China's crackdown on tech stocks.

Stock prices plummeted

The first and most obvious effect of China's crackdown on tech stocks was the immediate drop in stock prices. Companies like Alibaba, Tencent, and JD.com saw their shares tumble, wiping billions of dollars in market value. But fear not, my friend, for as the old saying goes, "buy low, sell high." If you're an investor with a long-term perspective, this could be the perfect opportunity to snatch up some discounted shares.

IPOs are on hold

China's tech crackdown has also put a hold on initial public offerings (IPOs). Companies planning to go public, such as ride-hailing giant Didi Chuxing, have had to postpone their plans due to regulatory uncertainty. While this may be frustrating for the companies and investors, it could also be considered good. By cracking down on IPOs, China ensures that only high-quality companies with solid fundamentals can go public.

Government intervention is increasing.

One of the main drivers of China's tech crackdown is the government's desire for greater control over the industry. This has increased government intervention in everything from antitrust issues to data privacy. While this may seem negative for businesses, it could also lead to greater stability and predictability in the long run.

Innovation could suffer

Another potential downside of China's tech crackdown is that it could stifle innovation. With increased government intervention and regulatory scrutiny, companies may be less willing to take risks and develop new technologies. However, as we'll see in a moment, there are also some potential upsides.

Foreign investors are wary.

China's tech crackdown has also made foreign investors wary of investing in Chinese tech companies. With regulatory uncertainty and the risk of government intervention, many investors are taking a wait-and-see approach. This could reduce foreign investment in the short term and lead to a more stable and sustainable long-term investment environment.

Opportunities for smaller players

One potential upside of China's tech crackdown is that it could create opportunities for smaller players. With the big tech giants facing regulatory headwinds, smaller companies could have a chance to gain market share and compete on a more level playing field. This could lead to greater innovation and diversity in the tech industry.

Greater emphasis on profitability

One of the main criticisms of China's tech giants has been their focus on growth at the expense of profitability. However, the crackdown could change that. With increased regulatory scrutiny and a tougher business environment, companies may be forced to focus more on profitability and sustainable growth. This could lead to a healthier and more stable tech industry.

Antitrust issues

Another major driver of China's tech crackdown is the government's focus on antitrust issues. Companies like Alibaba and Tencent have been accused of using their dominant market positions to stifle competition. However, with increased regulatory scrutiny, these issues are finally being addressed. This could lead to a more competitive and diverse tech industry.

Cybersecurity concerns

In addition to antitrust issues, China's tech crackdown addresses cybersecurity concerns. With the proliferation of data breaches and cyber-attacks, the Chinese government is cracking down on companies that are not taking data security seriously. This action could lead to a more secure and trustworthy tech industry.

Tech companies are diversifying.

Finally, one potential upside of China's tech crackdown is that it could encourage companies to diversify. With increased regulatory scrutiny and a more challenging business environment, companies may be forced to look for new revenue streams and business models. This could lead to greater innovation and a more dynamic tech industry.

In conclusion, while stock prices have plummeted and IPOs are on hold, the crackdown could also lead to greater government intervention, more emphasis on profitability, and addressing antitrust and cybersecurity issues. It could also create opportunities for smaller players and encourage tech companies to diversify.