The Role of Artificial Intelligence in Stock Market Analysis

Author: Franco Salzillo

Artificial intelligence has become an indispensable tool in various industries, and one of the areas where it has shown significant potential is in stock market analysis. Despite not having a personal stake in the stock market, AI algorithms can process large amounts of data and perform complex calculations, leading to more informed investment decisions. In this piece, we will discuss the role of artificial intelligence in stock market analysis and how it is changing the landscape for companies and investors alike.

The rise of AI in stock market analysis

Traditionally, stock market analysis has been the realm of human investors, who pore over reams of financial data and make informed decisions based on their experience and intuition. However, the introduction of AI in recent years has changed the game. Machines can now process and analyze vast amounts of data at lightning speed, providing insights that would be impossible for humans to discern.

For example, AI algorithms can analyze news articles, social media posts, and satellite images to identify trends and predict how they will impact the stock market. They can also detect patterns in historical data that humans might miss, leading to more accurate predictions.

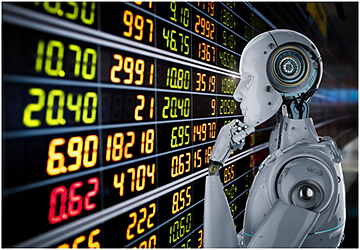

AI in action

One company that has embraced the power of AI in stock market analysis is BlackRock, the world's largest asset manager. BlackRock uses AI to analyze news articles, financial reports, and other data sources to identify companies likely to outperform their peers. They also use AI to manage their vast portfolio of investments, making decisions about buying and selling stocks based on real-time data.

The hedge fund Renaissance Technologies also uses AI to analyze large data sets and make investment decisions. The company's Medallion fund has consistently outperformed the market for years, earning its investors billions of dollars in profits.

Even retail investors are getting in on the action, with companies like Robinhood and eToro using AI algorithms to help their users make better investment decisions. These platforms analyze user data to make personalized investment recommendations, helping novice investors navigate the complex world of the stock market.

Here are a few more examples of companies using AI in stock market analysis;

● IBM Watson: IBM Watson is a leading AI platform used in various industries, including finance. The platform is designed to analyze large volumes of data, including financial data, and use machine learning algorithms to make predictions and recommendations.

● Kavout: Kavout is a company that specializes in using AI to analyze stocks and make investment recommendations. The company's AI algorithms analyze various data sources, including financial statements, news articles, and social media posts, to identify trends and predict stock prices.

● Sentieo: Sentieo is a financial research platform that uses AI to help investors make more informed decisions. The platform's AI algorithms analyze financial data, news articles, and social media posts to identify investment opportunities and risks.

● Accern: Accern is a company that provides various AI-powered solutions for financial institutions, including stock market analysis. The company's AI algorithms analyze news articles and social media posts to identify trends and predict stock prices.

Benefits of AI in stock market analysis

The benefits of using AI in the stock market analysis are numerous. Firstly, machines can process and analyze vast amounts of data quickly and accurately compared to humans. This allows for more informed investment decisions and better risk management.

AI can also identify patterns and trends that might be invisible to humans, leading to more accurate predictions. For example, AI algorithms can detect anomalies in financial data that might indicate fraudulent activity, which can be difficult for humans to spot.

Additionally, AI can help reduce bias in investment decisions. Their experiences and biases often influence humans, leading to suboptimal investment decisions. On the other hand, machines make decisions based solely on the data they are given, leading to more objective decision-making.

Limitations of AI in stock market analysis

AI is not a panacea for stock market analysis. There are limitations to what machines can do and risks associated with relying too heavily on them.

One limitation is the quality of the data used to train AI algorithms. Garbage in, garbage out, as they say. If the dataset used in training the algorithm is biased or inaccurate, the algorithm will produce biased or inaccurate results.

Another limitation is the lack of transparency in some AI algorithms. Some machine learning algorithms are so complex that it's difficult for humans to understand how they arrived at a particular decision. This can lead to mistrust and skepticism, as investors may hesitate to rely on a decision they don't understand.

Finally, there is the risk of overreliance on AI. While machines can process and analyze vast amounts of data, they are still limited by the quality and quantity of data they are given. Additionally, there is always the risk of unexpected events that can disrupt the stock market and throw AI algorithms off track. As such, investors must use AI in conjunction with human analysis and judgment rather than relying solely on machines.

The future of AI in stock market analysis

Despite its limitations, the future looks bright for AI in stock market analysis. As machines become more advanced and data sets grow, AI will become even more powerful and accurate in predicting market trends and identifying investment opportunities.

There will also be advancements in the transparency and interpretability of AI algorithms, making it easier for humans to understand how decisions are made. This will increase trust in AI and lead to greater adoption of these technologies in the investment industry.

To sum it up

AI is revolutionizing the world of stock market analysis. By processing and analyzing vast amounts of data, machines can make predictions and identify trends humans might miss. While there are limitations to what AI can do, the benefits are clear - better investment decisions, reduced bias, and improved risk management. As machines become more advanced and data sets grow larger, we can expect to see even more powerful and accurate AI algorithms in the future. So, let's welcome our new AI overlords to the investing world - after all, they might make us all rich!